As global demand for titanium feedstock, especially ilmenite, continues to rise, emerging producers are getting more attention. Nigeria, long known for its oil and gas, is fast becoming a serious contender in the titanium supply chain. Here are seven compelling reasons why buyers, investors, and industrial users should watch Nigeria for stable, high-volume ilmenite (50-73% TiO₂ grade) supply.

1. Abundant Reserves & Strategic Geology

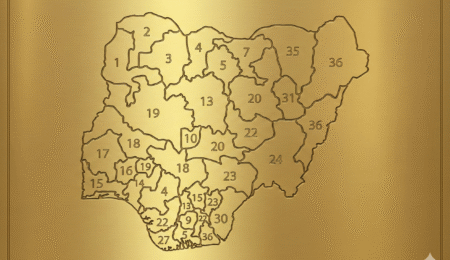

- Nigeria hosts large heavy mineral sands in many states (Akwa Ibom, Cross River, Benue, Ebonyi, Nasarawa, Kaduna, Plateau, Kano, Bauchi, etc) and riverine belts, which are known to contain ilmenite in commercially viable concentrations.

- Some estimates place Nigeria’s total ilmenite reserves in the hundreds of millions of tonnes.

- The country has multiple locations where ilmenite occurs naturally as beach sand, black sand, or in riverine deposits, making raw material sourcing more feasible.

2. Government Reforms Favoring Mining & Local Value Addition

- Nigeria has recently revoked many dormant mining titles and licences in an effort to make the licensing regime more dynamic and open.

- New policies are being considered / implemented to grant mining licences only to companies with plans for local processing / value addition. This suggests that the government is pushing to move up the value chain rather than just raw ore export.

- These reforms improve regulatory clarity, reduce bureaucratic delays, and aim to attract more serious investors in the solid minerals sector.

3. Competitive Cost Structure & Export-Efficiency

- Nigeria’s cost of operations, particularly when using 40-ft containers, bulk trucking, local taxes & royalties, is competitive when properly managed. When logistics economies are achieved, FOB costs per ton become more attractive.

- Truckload-based royalty/tax collection in states (rather than per ton) gives economies of scale: larger loads reduce the “per ton” burden.

- Local logistical practices (sorting, rebagging, warehouse consolidation) also help in reducing wastage and extra handling costs before shipment.

4. Increasing Global Demand for Titanium Feedstocks (TiO₂)

- Titanium dioxide (TiO₂) remains one of the world’s essential pigments for paints, plastics, paper, coatings, and other complex industrial applications. Demand is expected to grow with global industrialization, infrastructure rebuilds, and rising standards in material finishes.

- Additionally, demand in aerospace, medical prosthetics, and specialty alloys requires titanium feedstocks of stable supply and known specification. Countries and companies are seeking reliable, politically stable sources outside traditional suppliers.

5. Export Potential via Major Nigerian Ports (Lagos & Port Harcourt)

- Nigeria has well-established ports like Lagos (Apapa / Tin Can Island) and Port Harcourt (Onne) for shipping large bulk consignments. These ports, while facing operational challenges such as delays, are accessible for FOB exports.

- Recent improvements and attention to port handling, shipping agent services, and customs clearance are helping reduce transit delays and port surcharge costs.

- The proximity of mining-regions (or heavy mineral sands deposits) to the coast reduces haulage distance compared to inland mining operations in other jurisdictions.

6. Policy Momentum Towards Transparency, Regulation & Legitimacy

- The Nigerian government has stepped up crackdowns on illegal mining and unlicensed operators (for example, in Kwara and Akwa Ibom state), sending a signal that legitimate, licenced suppliers will have advantages in market access and reputation.

- Revocation of unused mining titles shows that authorities are trying to ensure mining licences are active and effective, which helps buyers know they are dealing with credible suppliers.

- There’s growing pressure (both domestic and international) to ensure ESG‐compliance (environmental, social, governance) in mineral supply chains. Nigeria’s regulation reforms are moving in that direction.

7. Room for Growth & Margin Capture

- Since much of Nigeria’s ilmenite mining/export sector is still under-developed and dominated by smaller or informal operators, there is significant potential for scale. Suppliers who can meet volume, consistency, and quality (e.g., 50-73% TiO₂, low impurities, proper bagging / loading) stand to benefit from favorable terms.

- As value addition (beneficiation, local processing, better logistics) improves, suppliers in Nigeria can capture higher margins. Buyers seeking feedstock benefit from cost savings when buying directly from primary sources.

- The global trend toward “secure supply chains” is giving an edge to emerging producers who can prove legitimacy and traceability. Nigeria, with its reforms, can increasingly benefit here.

⚠️ But Be Aware: Challenges That Must Be Managed

To succeed, Nigerian suppliers and exporters must address certain constraints:

- Infrastructure gaps (roads, reliable electricity) in remote mining areas.

- Regulatory / licence complexity, overlapping authority between federal/state levels, delays in approvals.

- Logistics & port bottlenecks– warehousing, trucking, containerization, customs clearance.

- Illegal mining & informal trade, which undermine pricing integrity and government support.

- Quality consistency– buyers expect assay reports, consistent TiO₂ grade, and minimal impurities.

✅ What This Means for Buyers & Suppliers

If you’re a buyer in pigment, aerospace, or manufacturing sectors, Nigeria offers a compelling option for long-term supply of high-grade ilmenite feedstock. With improved regulation and the right sourcing partner, you can negotiate favorable FOB terms, reduced supply risks, and transparent traceability.

If you’re a supplier or investor, aligning with reforms, securing proper licensing, investing in beneficiation/logistics, and offering reliable quality will unlock premium value, both in domestic export contracts and in global markets.

To explore Nigeria’s ilmenite supply first-hand, get in touch via our latest FOB offering for 50-73% TiO₂ grade Ilmenite, containerized and port-ready.

Ilmenite (Titanium Ore) Sourcing & Export Services – FOB Nigeria

Contact us today to request delivery schedules. Your steady, certified supply chain starts here.

READ ALSO:

How to Buy Lead Ore from Nigeria: 12 Things Every Smart Buyer Must Know

Leave a Reply